In this article, we will answer the question what is Bitcoin halving, exploring its purpose, mechanics, and implications.

What is Bitcoin Halving?

Bitcoin halving is a crucial and highly anticipated event within the world of cryptocurrencies. It is a process that occurs approximately every four years and plays a significant role in shaping the Bitcoin network.

Bitcoin halving refers to the reduction in the rate at which new Bitcoins are created and awarded to miners. This process is programmed into the Bitcoin protocol and occurs after every 210,000 blocks are mined.

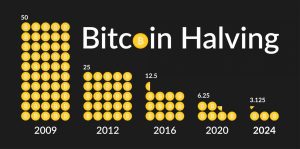

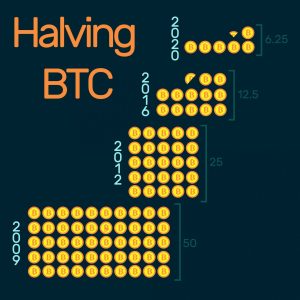

With each halving event, the reward for successfully mining a block is cut in half, hence the term “halving.” Initially, the block reward was set at 50 Bitcoins, and it has gone through two halvings since then.

The purpose of Bitcoin halving is twofold. First, it helps control the inflationary supply of Bitcoin. By reducing the rate of new Bitcoin issuance, halving ensures that the total supply of Bitcoin grows at a predictable and decreasing pace. This scarcity contributes to the underlying value proposition of Bitcoin as a store of value and digital gold.

What is Bitcoin Halving? It is also a mechanism to gradually introduce new Bitcoins into circulation and distribute them among miners who secure the network. It incentivizes miners to invest resources, such as computational power and energy, to validate transactions and maintain the integrity of the blockchain. As the block reward decreases, miners must rely more heavily on transaction fees to sustain their operations.

The mechanics of Bitcoin halving are predetermined and encoded into the Bitcoin protocol. The halving occurs automatically and is triggered by the block height, not a specific date.

Approximately every ten minutes, a new block is added to the blockchain, and when the 210,000th block is reached, the halving takes place. This ensures that the block reward is reduced by 50%, from the previous value, and the process repeats.

Bitcoin halving events have far-reaching implications for various stakeholders within the cryptocurrency ecosystem. Miners, who are crucial to the network’s security and transaction validation, are directly impacted.

As the block reward diminishes, their profitability is affected, and they must adapt their strategies to maintain sustainable operations. Some less efficient miners may find it unprofitable to continue mining, leading to potential changes in mining concentration and geographic distribution.

Moreover, Bitcoin halving events have historically been associated with significant price movements and market dynamics. As the supply of newly minted Bitcoins entering the market decreases, the reduced selling pressure may contribute to upward price pressure, assuming demand remains constant or increases.

However, it is important to note that market forces, investor sentiment, and other factors can influence Bitcoin’s price in complex ways, making it challenging to predict precise outcomes based solely on halving events.

Analyzing the historical data of previous halving events provides insights into potential patterns and trends. The first halving occurred in November 2012, followed by the second halving in July 2016.

In both instances, Bitcoin experienced significant price rallies in the months and years following the halvings. However, it is essential to exercise caution when drawing conclusions from historical data, as past performance does not guarantee future results.

In summary, What is Bitcoin Halving? It is a pivotal event that occurs every four years, reducing the rate of new Bitcoin issuance and impacting various aspects of the cryptocurrency ecosystem.

It serves as a mechanism to control inflation, incentivize miners, and shape the supply and demand dynamics of Bitcoin. Understanding the concept and implications of Bitcoin halving is crucial for investors, enthusiasts, and participants in the cryptocurrency market.

What is Bitcoin Halving? It is a process that shapes the future of Bitcoin, and as the next halving approaches, the excitement and anticipation surrounding its potential outcomes continue to captivate the crypto community.

As the Bitcoin network evolves, future halvings will undoubtedly shape the narrative of this revolutionary digital currency, solidifying its position in the global financial landscape.

What is Bitcoin Halving and Its Implications

Bitcoin halving, also known as the halving of Bitcoin rewards, is a crucial event in the world of cryptocurrencies. It occurs approximately every four years and has a significant impact on various aspects of the Bitcoin ecosystem. Understanding what Bitcoin halving is and its implications is essential for anyone seeking to comprehend the dynamics of the Bitcoin network.

Bitcoin halving is a predetermined process embedded in the Bitcoin code. It serves the purpose of controlling the supply of new Bitcoins entering circulation. “What is Bitcoin Halving” is a question that arises when we delve into the intricacies of this process.

The answer lies in the fact that during each halving event, the mining rewards earned by miners are reduced by half. This reduction takes place at fixed intervals and helps regulate the creation of new Bitcoins.

The initial mining reward per block was set at 50 Bitcoins. However, the first halving in 2012 brought it down to 25 Bitcoins. Subsequently, the second halving in 2016 further reduced the reward to 12.5 Bitcoins.

The most recent halving took place in 2020, and it decreased the reward to 6.25 Bitcoins. This periodic reduction in mining rewards has important implications for miners and the overall Bitcoin ecosystem.

What is Bitcoin Halving’s impact on miners? The reduction in mining rewards directly affects their profitability. As the rewards are halved, miners receive fewer newly minted Bitcoins for their efforts.

This can make it increasingly challenging for miners to cover expenses such as electricity costs and mining equipment. It puts smaller and less efficient mining operations at risk of becoming unprofitable and potentially shutting down.

“What is Bitcoin Halving’s impact on Bitcoin’s price?” is a question frequently asked when discussing this event. The reduction in the supply of new Bitcoins due to halving puts upward pressure on the price. As the supply becomes scarcer, the existing Bitcoins may increase in value.

This relationship between Bitcoin halving and price dynamics has been observed in previous halving events. However, it is important to note that the correlation does not guarantee future price increases.

“What is Bitcoin Halving’s historical pattern?” Analysis of historical data reveals intriguing patterns associated with halving events. Prior to each halving, Bitcoin has experienced notable price surges.

This is often followed by periods of consolidation or correction. Some speculate that these price appreciations occur due to the anticipation and excitement surrounding the halving, coupled with the expectations of decreased supply.

After the halving, the Bitcoin mining industry undergoes significant changes. The reduction in mining rewards leads to consolidation in the sector. In other words, miners who operate at higher costs may struggle to remain profitable and may be forced to exit the market.

On the other hand, larger and more efficient mining operations with access to cheaper electricity and specialized mining hardware have a better chance of surviving and thriving. This consolidation can enhance the decentralization of the network by favoring geographically distributed mining operations.

What is Bitcoin Halving’s impact on the broader cryptocurrency market? As the leading cryptocurrency, Bitcoin sets the tone for the entire market. The sentiment surrounding Bitcoin halving can influence investor behavior and market sentiment across the cryptocurrency landscape.

It is not uncommon to observe increased volatility and heightened market activity during these periods. Traders and investors react to the potential impact of Bitcoin halving on its price and the subsequent ripple effects on other cryptocurrencies.

In summary, understanding what Bitcoin halving is and its implications is crucial for comprehending the dynamics of the Bitcoin ecosystem. Bitcoin halving regulates the supply of new Bitcoins and affects miners’ profitability, Bitcoin’s price dynamics, and market behavior.

The historical patterns associated with halving events provide insights, but it is important to approach the topic with caution, considering the complexity of the cryptocurrency market.

What is Bitcoin Halving: A Historical Analysis

Bitcoin halving is an essential aspect of the Bitcoin network’s monetary policy. Occurring approximately every four years, Bitcoin halving plays a significant role in controlling the supply of Bitcoins.

So, what is Bitcoin halving, and how does it impact the cryptocurrency market? In this article, we will delve into the historical analysis of Bitcoin halving events and explore their implications.

Bitcoin halving refers to the predetermined event that halves the rate of Bitcoin production and distribution to miners. It serves as a mechanism to limit the number of Bitcoins entering circulation.

The first Bitcoin halving event occurred in November 2012, followed by subsequent halvings in July 2016 and May 2020. These halvings reduced the block rewards from 50 to 25, 25 to 12.5, and 12.5 to 6.25 Bitcoins, respectively.

When discussing Bitcoin halving, it is crucial to consider its impact on mining rewards. Miners, who validate transactions and secure the Bitcoin network, receive block rewards for their efforts.

What is Bitcoin halving’s effect on mining rewards? With each halving, mining rewards are cut in half, significantly impacting miners’ profitability. The reduction in rewards often leads to changes in mining behavior, prompting miners to adopt more energy-efficient practices to maintain profitability.

Now let’s explore the implications of Bitcoin halving on price and market dynamics. Historical analysis suggests that previous halving events have been associated with substantial price rallies. The decrease in Bitcoin issuance, combined with growing demand and scarcity, exerts upward pressure on its price.

However, it’s important to note that the relationship between halving events and price is complex, as other factors such as market sentiment and adoption also contribute to Bitcoin’s price movements.

Analyzing the historical data surrounding Bitcoin halving events unveils intriguing patterns and correlations. The first halving in 2012 occurred when Bitcoin was still in its early stages.

This event acted as a catalyst, drawing attention to the cryptocurrency and resulting in a significant price increase in the subsequent months. Similarly, the 2016 halving marked a turning point for Bitcoin, initiating a prolonged bull market that drove the price to new all-time highs.

The most recent halving in 2020 provides valuable insights into Bitcoin’s behavior. Following the event, Bitcoin experienced heightened price volatility, reaching new highs and capturing the interest of retail and institutional investors. This increased attention and mainstream adoption further solidified Bitcoin’s position as a significant asset within the global financial landscape.

While past performance does not guarantee future results, analyzing the historical trends of Bitcoin halving events is informative for understanding future halvings. The next halving is expected to occur in 2024, reducing the block reward to 3.125 Bitcoins.

As the Bitcoin ecosystem continues to evolve, comprehending the historical significance of halving events remains crucial for investors, traders, and enthusiastsitcoin halving is a fundamental aspect of the Bitcoin network’s protocol, designed to regulate the supply of new Bitcoins. Through a historical analysis of previous halving events, we have observed their impact on mining rewards, price dynamics, and the overall growth of Bitcoin.

Understanding the historical trends of Bitcoin halving contributes to a better understanding of the cryptocurrency ecosystem. So, what is Bitcoin halving? It is a significant event that shapes the future of Bitcoin and the broader digital asset landscape.

Conclusion

Bitcoin halving is a significant event in the cryptocurrency world, occurring approximately every four years. It involves the reduction of the block reward given to miners, resulting in a controlled inflationary supply of Bitcoin. This process helps maintain scarcity and incentivizes miners to secure the network.

Bitcoin halving has implications for miners, market dynamics, and historical analysis. Miners need to adapt to lower block rewards, while market movements and investor sentiment can be influenced by halving events. Historical data shows price rallies following previous halvings, but caution should be exercised. Understanding Bitcoin halving is crucial for those involved in the crypto market.

Hello Readers!!! Dipprofit Community is now on Threads, the new Twitter-like app, and we would like for you to follow us there, so we can also interact better and provide you with some educational tips and nuggets. Thanks for the follow!