Trading Indicators

Trading indicators are like oxygen to traders who use technical analysis in analyzing the financial market so as to speculate price movement. Therefore it is very important for every trader that falls into this category to properly understand the crucial role trading indicators play in their analysis. Every trader that uses technical analysis knows how valuable trading indicators can be, but many don’t understand that choosing an indicator is reliant on several factors.

Every trader, therefore, needs to consider these factors before they get to know the best and most suitable indicators for themselves, which, in turn, increases the trader’s options and also makes utilization of these trading indicators optimized and more effective.

Some of the factors that these traders need to consider when choosing or making use of any trading indicator are; how effective the indicators can be in relation to the commodities and instruments being traded, The trading strategy the trader is making use of, the timeframes the trader is making use of and the volatility level of the market being traded. These are some of the important factors to consider when choosing a great trading indicator.

To better understand these factors, it is also essential to know how these trading indicators function, which is what we will be looking at in this article. I will be identifying and explaining some of the best and most effective trading indicators in the financial market, their strengths, the best usage conditions, and how they can be applied while trading the financial market. Getting to know these trading indicators, how they assist in market analysis, and the roles they play, makes it easier for every trader to easily make a choice each time they need an indicator to complement their trading style.

Now that we understand the intent of this article, we need to know what trading indicators mean, to help us better understand the rest of the article.

Meaning of Trading Indicators

Trading indicators serve as indispensable tools utilized by traders and investors to thoroughly analyze financial markets and make well-informed decisions regarding the purchase or sale of assets. These indicators are derived from mathematical calculations and statistical data, which are based on crucial market-related information such as price movements, trading volume, and more.

Trading indicators play a crucial role in identifying emerging trends, detecting price patterns, and signaling potential market reversals. They offer valuable insights into prevailing market conditions, empowering traders to generate informed trading signals. As I have stated earlier, there are several trading indicators and each of them has their strong point and varying level of usefulness. Therefore, at the end of this article, you as a trader should be able to easily identify the indicator that suits you the most.

Now that we already know the meaning of a trading indicator and its functions, let now take a look at the various types of trading indicators we have and their utility.

Types of Trading Indicators

There are basically two (2) categories of indicators and every indicator you see today falls under basically one of the categories. The two (2) categories of indicators are known as Leading Indicators and Lagging Indicators.

Leading indicators:

Leading indicators serve as forward-looking metrics, offering early indications of potential changes or trends within a specific phenomenon. Their purpose is to forecast and predict future events or outcomes. Proactive in nature, leading indicators enable businesses and analysts to make well-informed decisions ahead of time. For instance, in the stock market, leading indicators may include economic indicators such as the Purchasing Managers’ Index (PMI) or the consumer confidence index. These indicators provide valuable insights into the future direction of the economy.

Leading indicators are mostly used for fundamental analysis, as they are used to forecast and speculate future events and outcomes.

Lagging indicators:

Lagging indicators, on the contrary, function as retrospective metrics, confirming and quantifying the performance of a phenomenon or trend after it has transpired. They trail behind the phenomenon being measured and are utilized to validate or evaluate the impact of past events or actions. Reactive in nature, lagging indicators shed light on historical data. Within the business realm, lagging indicators could encompass metrics such as revenue growth, profitability, or customer satisfaction scores, all of which reflect a company’s past performance.

In essence, lagging indicators authenticate and measure the performance of past events. These indicators are mostly used by traders for technical analysis, and these are the indicators I will be talking about today. Now let’s talk about some of the best trading indicators that every trader can use to improve their trading chances in the financial market.

Read Also: How to Trade Like a Pro Using SMC Trading Strategy

The Best Trading Indicators

- Moving Averages

- Relative Strength Index

- Bollinger Bands

- Moving Average Convergence Divergence (MACD)

- Stochastic Oscillator:

- Average True Range

- Fibonacci Retracement

- Ichimoku Cloud

Moving Average:

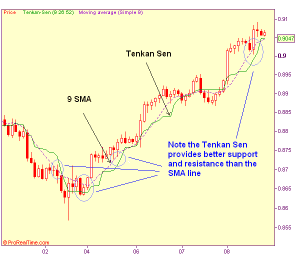

The moving average is a trading indicator widely used in financial markets to smoothen price data and identify the underlying trend. It is a basic indicator that all beginner traders should also try to understand, as it has several uses. It calculates the average price over a specific time period and displays it as a line on a price chart. By eliminating short-term price fluctuations, moving averages provide a clearer picture of the overall trend. The moving average has a lot of uses and we will be examining them briefly.

Identifying the Trend

One of the primary purposes of using moving averages is to determine the direction of the trend. Traders often consider two types of moving averages: the short-term moving average and the long-term moving average. The short-term moving average, such as a 50-day moving average, reacts more quickly to recent price changes, while the long-term moving average, such as a 200-day moving average, responds more slowly.

When the price is consistently above the moving average line, it indicates an uptrend. Conversely, when the price remains below the moving average line, it suggests a downtrend. By observing the relationship between the price and the moving average, traders can make informed decisions about buying or selling assets.

Serve as Support and Resistance Levels

Moving averages also help identify potential support and resistance levels. Support refers to a price level where buying pressure is expected to outweigh selling pressure, causing the price to bounce back up. Resistance, on the other hand, is a price level where selling pressure is anticipated to surpass buying pressure, resulting in a price decline.

When the price approaches a moving average from below and bounces back, it indicates potential support. Conversely, if the price approaches a moving average from above and faces rejection, it suggests possible resistance. Traders often monitor these levels to determine optimal entry or exit points for their trades.

Different Types of Moving Averages

There are different types of moving averages and each of them offers their own perspective on price trends. The most commonly used moving averages include the simple moving average (SMA) and the exponential moving average (EMA).

Simple Moving Average

The simple moving average calculates the average price over a specified period by equally weighting each data point. It is straightforward to calculate but may be more prone to lag behind the latest price movements.

The simple moving average is very easy to understand and is simply calculated by adding prices over a given number of periods, then dividing the sum by the number of periods.

For example; a 50-day SMA would add the closing prices for the last 50 days and then divide the total number by 50; this is similar to a simple arithmetic mean. Each time a new period occurs, the moving average moves forward dropping its first data point and adding the newest one.

Let’s use a 6-day moving average as a practical example:

Last Closing Prices for Google, assuming googles stock price is currently at $43

$43.41, $43.52, $43.21, $43.77, $43.58, $43.63 = $261.12

To calculate SMA, divide the total closing prices by the number of periods

6-day SMA= $261.12/6 = $43.52

From the above calculation, we will discover that the 6-day SMA for the Google price will be on the $43.52 price level, and at that point, it can either form a support or a resistance zone for price movement.

Exponential Moving Average

The exponential moving average, on the other hand, assigns greater weight to recent data points, making it more responsive to recent price changes. As a result, the EMA can provide traders with quicker signals when the trend starts to shift, as compared to the simple moving average.

Since it gives greater weight to most recent prices it is calculated by applying a percentage of today’s closing price to the recent(yesterday) moving average.

To understand how the EMA is calculated, you should read my article on moving averages, as it will be properly illustrated there.

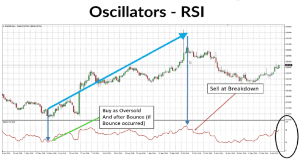

Relative Strenght Index:

The Relative Strength Index (RSI) is one of the most common trading indicators in the field of trading and investment and it plays a crucial role in identifying the market condition, specifically whether it is overbought or oversold.

The RSI consists mainly of an indicator line that is used to determine the market’s position and various levels that help assess its condition. The RSI is mostly placed at the bottom of the trading chart while conveniently placed alongside the main chart, providing valuable insights to traders and investors.

Overbought and Oversold Conditions

The RSI is a trading indicator that helps the trader determine whether an instrument or commodity is in an overbought or oversold market position. The top end of the RSI scale is referred to as the overbought zone, which means that the market has experienced a significant price increase and may be due for a correction. Conversely, the bottom end is called the oversold zone, which means that the market has witnessed a significant decline and may be primed for a potential rebound.

Advantages:

One of the RSI’s notable strengths lies in its effectiveness during sideways market conditions. When the market lacks a clear trend and exhibits horizontal movement, the RSI can be a reliable tool for traders to identify potential entry and exit points. By analyzing the RSI’s readings, traders can gain insights into market volatility and make informed decisions accordingly.

Importance:

The RSI holds immense significance in the world of trading due to its ability to provide valuable insights into market conditions. Some of the reasons why lots of traders make use of the RSI is that it helps to spot divergence in market conditions and movement, and it also assists the trader to get better timing in their trades.

Read Also: 8 Chart Patterns Every Beginner Trader Must Know to Succeed in Trading

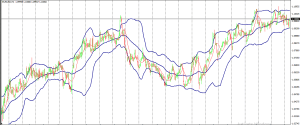

Bollinger Bands:

Bollinger Bands is also among one the popular trading indicators used by traders to assess volatility and identify overbought or oversold conditions in financial markets.

Bollinger Bands consist of three key components namely: the simple moving average (SMA) and two standard deviation lines. The SMA serves as the centerline, while the upper and lower bands represent the standard deviation from the SMA. This combination creates an envelope around the price chart, which helps visualize volatility.

Interpreting Bollinger Bands

In most cases, traders utilize Bollinger Bands to identify potential trading opportunities based on price movements relative to the bands. Here are some key interpretations:

- Volatility Assessment: Bollinger Bands provide a visual representation of market volatility. When the bands are wider, it suggests higher volatility, and when they are narrower, it indicates lower volatility.

- Overbought and Oversold Conditions: When the price touches or crosses the upper band, it may indicate overbought conditions, suggesting a potential reversal or correction. Conversely, a touch or cross of the lower band may suggest oversold conditions, implying a possible upward price movement.

There are many more ways in which Bollinger bands can be used as a trading indicator while trading the financial markets, and we will be giving you a more detailed explanation of how to apply Bollinger bands in your trading strategies in our upcoming articles, just stick with us by subscribing to our newsletter and hitting the bell icon button to get an instant notification each time I drop a new article.

Moving Average Convergence Divergence (MACD)

The Moving Average Convergence Divergence (MACD) is a widely used momentum indicator that helps traders identify trends and potential trend reversals in financial markets. It provides valuable insights into the relationship between two moving averages of different time periods.

Understanding the MACD

The MACD is made up of three key elements: the MACD line, the signal line, and the histogram. Let’s expatiate on each of these components.

- MACD Line: This line is calculated by subtracting the longer-term exponential moving average (EMA) from the shorter-term EMA. It represents the difference between the two moving averages and serves as the primary indicator in the MACD.

- Signal Line: This line is the moving average of the MACD line itself. Normally, a 9-day EMA is used for this purpose. The signal line helps smooth out the MACD line and generate trading signals.

- Histogram: The histogram represents the difference between the MACD line and the signal line. It shows a visual representation of the convergence and divergence between the two lines. Positive values indicate bullish momentum, while negative values suggest bearish momentum.

How to Interpret the MACD

The MACD is used in identifying potential trading opportunities using crossovers and divergences. Below are some of the key explanations:

- Crossovers: The bullish crossovers occur when the MACD line crosses above the signal line, signaling a potential upward trend. Conversely, the bearish crossovers occur when the MACD line crosses below the signal line, indicating a possible downward trend.

- Divergences: Divergences occur when the MACD line and the price chart move in opposite directions. Bullish divergences are observed when the price forms lower lows, but the MACD line forms higher lows, suggesting a potential trend reversal to the upside. Bearish divergences occur when the price forms higher highs, but the MACD line forms lower highs, indicating a possible trend reversal to the downside.

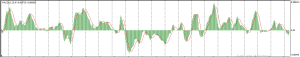

Stochastic Oscillator:

The Stochastic Oscillator is one of the popular trading indicators used by traders in identifying overbought and oversold conditions in financial markets. It is similar to the RSI in its functionality. The stochastic indicator is used in comparing the closing price of an instrument or asset to its price range over a specific period, the Stochastic Oscillator also provides valuable insights into potential trend reversals. Let’s take a quick look at the intricacies of the Stochastic Oscillator, its components, and how traders can effectively utilize this indicator to make informed trading decisions.

Understanding the Stochastic Oscillator

The Stochastic Oscillator consists of two lines: the %K line and the %D line.

- %K Line: The %K line simply represents the current closing price’s position in relation to the price range over a specified period. It moves between 0 and 100 and is considered the faster line in the Stochastic Oscillator.

- %D Line: The %D line is a moving average of the %K line and is seen as the slower line. It smooths out the %K line and provides a more reliable signal. The %D line is mostly represented by a dashed line on the oscillator chart.

Interpreting the Stochastic Oscillator

The Stochastic Oscillator helps traders identify potential trading opportunities based on overbought and oversold conditions. Here are the key interpretations:

- Overbought Conditions: When the %K line rises above a certain threshold (usually 80), and then crosses below the %D line, it indicates that the security may be overbought. Overbought conditions suggest that the price may be due for a downward correction or a trend reversal.

- Oversold Conditions: Conversely, when the %K line falls below a specific threshold (typically 20), and then crosses above the %D line, it suggests that the security may be oversold. Oversold conditions imply that the price may be poised for an upward correction or a trend reversal.

- Divergences: Traders also look for divergences between the Stochastic Oscillator and the price chart. Bullish divergences occur when the price forms lower lows, but the %K line forms higher lows. This suggests a potential trend reversal to the upside. Bearish divergences occur when the price forms higher highs, but the %K line forms lower highs, indicating a possible trend reversal to the downside.

Utilizing the Stochastic Oscillator in Trading Strategies

Traders employ various strategies based on the Stochastic Oscillator’s signals. Here are a few common approaches:

- Stochastic Overbought/Oversold Strategy: Traders identify overbought conditions (above 80) as potential sell signals and oversold conditions (below 20) as potential buy signals. They enter trades when the %K line crosses above or below the %D line, confirming the overbought or oversold condition.

- Stochastic Divergence Strategy: Divergences between the Stochastic Oscillator and the price chart can be powerful reversal signals. Traders look for bullish or bearish divergences to anticipate trend reversals and enter trades accordingly.

- Stochastic Cross Strategy: Traders pay attention to the crossovers between the %K and %D lines. Bullish crossovers occur when the %K line crosses above the %D line, indicating a potential upward trend. Bearish crossovers occur when the %K line crosses below the %D line, suggesting a possible downward trend.

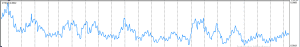

Average True Range:

The Average True Range (ATR) is one of the most powerful and effective trading indicators used by many professional traders to properly assess market volatility. It helps in measuring the average price range between high and low prices over a specific period, also providing valuable insights into market volatility and potential trading opportunities.

Understanding Average True Range

The Average True Range is a technical indicator that calculates the average trading range of a security over a given time period. Unlike other trading indicators that focus solely on price movements, the ATR looks at the gaps and limit moves as well. The ATR also provides traders with a measurement of the market’s volatility and can be applied to various trading instruments, including stocks, commodities, and forex.

Calculation of Average True Range

The Average True Range can be calculated using the following steps:

- Determine the true range (TR) for each period. The true range is the largest of the following:

- The difference between the current high and the current low.

- The absolute value of the difference between the current high and the previous close.

- The absolute value of the difference between the current low and the previous close.

- Calculate the average true range by taking the average of the true ranges over the specified period.

In most cases, the ATR is calculated over a 14-day period, but traders can adjust the period according to their preferences and trading style.

Read Also: The Ultimate Forex Scalping Strategy Guide

Fibonacci Retracement:

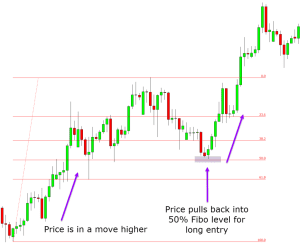

Fibonacci Retracement is another popular trading indicator, that many traders use in identifying the potential support and resistance levels during price corrections within larger market trends. This tool is based on the Fibonacci sequence, a mathematical pattern found in nature and the financial markets. Let’s briefly examine how the Fibonacci Retracement works and some of its key components.

Fibonacci Retracement uses horizontal lines to mark significant levels of potential support and resistance. These levels are derived from key ratios based on the Fibonacci numbers, including 23.6%, 38.2%, 50%, 61.8%, and 100%. The Fibonacci sequence is a series of numbers in which each number is the sum of the two preceding numbers (e.g., 0, 1, 1, 2, 3, 5, 8, 13, and so on).

Key Fibonacci Retracement Levels

There are essentially five (5) key Fibonacci levels, as shown below:

- The 23.6% Level: The 23.6% Fibonacci retracement level is often the shallowest retracement level. It suggests that the price may only pull back by approximately 23.6% of the previous move before resuming the larger trend.

- The 38.2% Level: The 38.2% retracement level represents a common retracement during a price correction. It indicates that the price may retrace around 38.2% of the previous move before continuing in the direction of the larger trend.

- The 50% Level: The 50% retracement level is not a Fibonacci ratio but is widely used in Fibonacci Retracement. Traders often consider the 50% level as a potential reversal or continuation point.

- The 61.8% Level: The 61.8% retracement level is a significant Fibonacci ratio. It suggests that the price may retrace approximately 61.8% of the previous move before continuing the larger trend.

- The 100% Level: The 100% retracement level indicates a complete retracement of the previous move, effectively bringing the price back to the starting point.

Fibonacci retracements allow traders to take a more calculated entry and exit in the market.

Ichimoku Cloud:

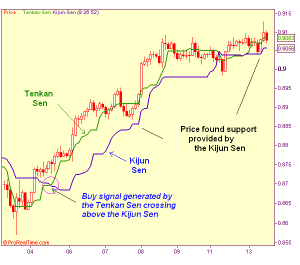

The Ichimoku Cloud is a complex but comprehensive trading indicator that provides helps traders properly understand the trend direction, support/resistance levels, and momentum in the financial markets. The Ichimoku cloud indicator was created by Japanese journalist Goichi Hosoda in the late 1960s, this indicator has since then gained widespread popularity among traders due to its ability to capture multiple aspects of market analysis in a single chart.

Ichimoku Components

The Ichimoku Cloud consists of several components that work together to provide a holistic view of the market. These components include:

- Tenkan-sen (Conversion Line): This line is calculated by averaging the highest high and lowest low over a specific period, typically 9 periods. It provides insights into short-term trend direction.

- Kijun-sen (Base Line): Similar to the Tenkan-sen, the Kijun-sen is calculated by averaging the highest high and lowest low over a longer period, usually 26 periods. It offers information about medium-term trend direction.

- Senkou Span A (Leading Span A): This component represents the average of the Tenkan-sen and Kijun-sen plotted forward 26 periods. It forms the lower boundary of the cloud and helps identify potential support/resistance levels.

- Senkou Span B (Leading Span B): The Senkou Span B is calculated by averaging the highest high and lowest low over an even longer period, typically 52 periods. It forms the upper boundary of the cloud and provides additional support/resistance levels.

- Kumo (Cloud): The area between Senkou Span A and Senkou Span B is known as the Kumo or cloud. It helps traders identify potential areas of support and resistance. The thickness and colour of the cloud can also provide visual cues about market sentiment.

- Chikou Span (Lagging Span): The Chikou Span represents the closing price plotted backward 26 periods. It helps traders assess the current market momentum and can be used to confirm or contradict other signals provided by the indicator.

How to use the Ichimoku Cloud

Traders analyze the Ichimoku Cloud using several key principles, some of which I will be mentioning below:

- Cloud Breakouts: When the price moves above or below the cloud, it is considered a potential signal for a trend reversal or continuation. A bullish breakout occurs when the price moves above the cloud, indicating a potential shift from a bearish to a bullish trend. Conversely, a bearish breakout occurs when the price moves below the cloud, suggesting a potential shift from a bullish to a bearish trend.

- Cloud Thickness: The thickness of the cloud can provide insights into the strength of support or resistance. A thicker cloud indicates a stronger support/resistance level, while a thinner cloud suggests a weaker level.

- Chikou Span Confirmation: Traders often look for confirmation from the Chikou Span. If the Chikou Span aligns with the current price and confirms the signal provided by other components, it strengthens the validity of the trading signal.

- Crossover Signals: Crossovers between the Tenkan-sen and Kijun-sen can indicate potential buy or sell signals. A bullish crossover occurs when the Tenkan-sen crosses above the Kijun-sen, suggesting a possible uptrend. Conversely, a bearish crossover occurs when the Tenkan-sen crosses below the Kijun-sen, indicating a potential downtrend.

Conclusion:

There is a very long list of trading indicators, and each has its strong points and utility, as mentioned earlier in the article. What then sets you apart as a trader in the financial market is not mastering every one of these indicators but rather identifying the trading indicators that best suit your style and strategy, sticking to it, and gaining complete mastery of the indicator.

Doing this will give you a much better advantage as a trader, especially when doing your technical analysis. This article is therefore targeted at briefly introducing some of the most common indicators to you, to help you understand their utilities better and decide on the particular ones that are useful to your trading style.

In my subsequent articles, I will be delving deeper into most of the trading indicators that have been mentioned in this article, giving detailed guides on how to apply them in your trading strategies, and implementing them properly. I hope you found some value in this article, if you do, kindly make a comment, and subscribe to our newsletter as I will be dropping more valuable educational articles. See you on the next one.

You can get this article in PDF format. Click the button below to download the trading indicators pdf guide format.

«« Download PDF »»

Hello Readers!!! Dipprofit Community is now on Threads, the new Twitter-like app, and we would like for you to follow us there, so we can also interact better and provide you with some educational tips and nuggets. Thanks for the follow!