SMC Trading Strategy

Introduction:

Trading, in general, requires a lot of techniques, experience, and expertise, as there are several factors that lead to successful trades, these factors range from technical analysis to the market fundamentals, to traders’ sentiments and economic conditions.

Most traders are therefore overwhelmed on many occasions while trading the market that they fail to cope with the market noise as they are unable to filter this noise out but rather get carried away by the endless buzzing sounds of charts, price movements, and so on that they end up losing themselves first before losing their equity.

This is one of the major reasons why we give in-depth articles here on Dipprofit to help guide traders on their journey and provide them with as much information and knowledge as they need, so as to make their trading journey easier, more focused, and more successful.

In this article, we will be looking at one of the best trading strategies every trader should know about and it is called the SMC trading strategy. The full meaning of SMC is Smart Money Concept, the SMC trading strategy is in a way similar to the supply and demand zones trading strategy we have also written about in one of our articles here because it helps the trader to easily determine the entry and exit positions of the big boys’ trades. By big boys, I mean institutional traders, hedge funds, and banks.

Understanding where these sets of traders take positions is one of the key factors to taking a successful trade and that is why the SMC trading strategy is revered amongst many other trading strategies.

So the questions that I guess should already be in your minds are: What really is SMC trading strategy? How can I apply the SMC trading strategy to my trade and how profitable would I become using the SMC trading strategy? All these questions will be answered in this article, so grab a cup of coffee, your notepad, and your mt4/mt5 interface, as we begin.

What is SMC Trading Strategy?

SMC trading strategy is a straightforward and traditional trading approach that relies on basic concepts like supply and demand, price action trading strategies, and support and resistance techniques to properly analyze entry and exit trade positions.

It is a process in which traders pay more attention to the actions of market makers (institutional traders, hedge funds, banks, etc) while analyzing the market structure. Through the use of the SMC trading strategy, traders can gain an edge in the Forex market.

While this trading strategy might seem unfamiliar at first, Smart Money Concept as it is mostly called is built upon traditional trading concepts such as supply and demand, price patterns, and support and resistance. The difference lies in its unique terminology which the SMC traders call them, SMC traders use concepts like “liquidity grabs” “market structure” and “mitigation blocks” while using the SMC trading strategy.

Despite this seemingly novel approach, SMC is, at its core, a more conventional trading method than you might expect. Rather than relying on complicated algorithms or advanced technical analysis, SMC’s trading strategy is founded upon a simple philosophy about how markets operate.

SMC asserts that market makers, entities such as banks, and hedge funds are manipulative by nature and that they actively work against retail traders, which seems to be true from my years of trading experience. As an SMC trader, you should therefore base your trading strategy on the actions of these “smart money” that is the money the market makers bring in and take from the market.

Essentially, the idea is to mirror the trades of market makers. By analyzing supply and demand zones, and market structure, you can gain insight into how these entities are trading and make informed decisions about your own trades.

In summary, while SMC may sound foreign due to its unique terminology, it is in fact a very simple and easy-to-understand strategy.

Now that we understand what SMC trading strategy is, we will be looking at how we can apply the SMC trading strategy to our trading, as I will be sharing valuable insights and techniques that will help you identify the best entry and exit points in the financial market using the SMC trading strategy and reducing risk exposure.

Before we learn how to trade using the SMC trading strategy, we would also need to understand some of the terms that SMC traders use, as we will be using them a lot in this article:

See Also: The Best Forex Brokers in USA 2023

Basic Terms Used in SMC Trading Strategy

- Change of Character (CHOCH): Change of character means, the market has changed its trend or order flow over a period of time.

- Break of Structure (BOS): “break of structure” is used to describe a significant price movement that surpasses a crucial level of support or resistance on a chart. This level is usually predetermined by institutional traders or other significant investors, who establish it as a critical threshold for market movement.

- Unmitigated Demand Zone: In the context of SMC trading strategy, “unmitigated demand zones” refer to price levels in a market where there is a high level of buying interest without significant selling pressure.

- Unmitigated Supply Zone: Unmitigated supply zones are the opposite as they refer to price levels in a market where there is a high level of selling interest without any significant buying pressure. To further understand how to identify demand and supply zones, you can read my article on that.

- Order Blocks: This is a trading block or a trading zone/point, that has massive buy or sell orders, they are what make up demand and supply zones. These order blocks are created by institutional traders and large investors and they form a significant point in the market.

- Liquidity in SMC Trading: “What does liquidity mean in SMC Forex? Liquidity signifies the degree to which an asset can be rapidly bought and sold, maintaining stable prices and facilitating its conversion into cash. It essentially represents the speed and cost associated with selling an asset, whether it’s a financial instrument like a stock or a tangible asset like a commercial property.”

Pros and Cons of The SMC Trading Strategy:

Pros of SMC Trading Strategy:

- Similarities with Price Action: SMC, being a repackaged form of price action, draws on a decades-long history of delivering results across various assets. The solid core of SMC lies in its connection to the well-established principles of price action.

- Enhanced Comprehension through SMC: For some, presenting price action as SMC makes it more accessible and easier to understand. The conceptual framework of SMC can simplify the understanding of price action dynamics.

- Helps in Unlocking Trading Success: Smart money concepts trading has proven effective for certain traders. If it works for you, there’s no reason to dismiss its utility. Consistently understanding and profiting from price behavior outweighs the need to comprehend the precise reasons behind price movements.

- Improves Liquidity Dynamics: While the theory that large institutions specifically target retail traders is questionable, the idea that larger institutions may at times influence smaller ones seems plausible. Despite presenting liquidity grabs in a debatable framework, some elements of SMC’s theoretical foundations may hold validity.

Cons of SMC Trading Strategy:

- Logical Inconsistencies: Certain aspects of SMC’s theories appear illogical when considering the limited relevance of retail traders to major players. Wholeheartedly embracing all aspects of SMC may lead to a misunderstanding of market fundamentals.

- Complex Learning Process: SMC’s alteration of terminology may complicate the learning process for price action, particularly for those already familiar with the standard language. Additionally, it may hinder the sharing of knowledge with others who adhere to the conventional price action language.

- Unverifiable Speculation: The theories behind SMC are speculative and cannot be proven or disproven. Concrete evidence, accessible only to insiders, is required to verify or refute SMC’s model of reality. Debates surrounding SMC are based on individual beliefs about institutional actions.

How to Trade Using the SMC Trading Strategy:

We would learn Smart money entry patterns and methods such as:

- SMC Reversal Entries

- How to identify valid CHOCH.

- Major and Minor change of character (CHOCH)

- Aggressive Entry setup

See Also: Common Terms in Forex: Spread, Pip, Lot size and Leverage

Entry Methods:

Firstly let us examine the entry method we can use in the SMC trading strategy. Smc entry methods are divided into two major subcategories namely:

- The reversal entry method

- The continuation entry method

The reversal entry method can further be divided into two namely:

- Change of character (CHOCH) or change of market structure.

- Flip entry setup.

In this article, I will use the reversal entry method to illustrate how to use the SMC trading strategy, and under the reversal method, we will be using the change of character (CHOCH) method, as it is easier to understand and is the one I am most familiar with.

It is important to note before we continue that this entry method should only be used in the higher timeframes demand and supply zones because these areas are seen to have high probability due to the sponsorship of the higher timeframe anything outside these zones immediately increases risk exposure.

Now let’s look at the reversal entry method using the Change of character (CHOCH) or market structure shift as it is called in conventional trading.

What is the meaning of Change of character (CHOCH)

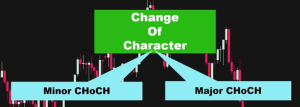

Change of character means the market has changed its trend or order flow over a period of time. Change of character can be further divided into two types namely:

Change of character means the market has changed its trend or order flow over a period of time. Change of character can be further divided into two types namely:

- Minor CHOCH

- Major CHOCH.

Identifying a valid change of character is a must-have for smart money traders as you would incur some losses if you fail to identify a valid CHOCH.

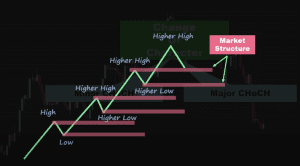

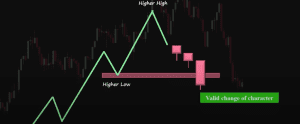

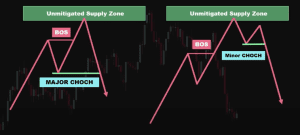

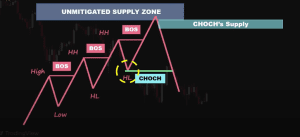

Let’s assume we have a bullish market, the price makes a series of higher highs and higher lows, as the diagram above, in this case, each high and low is the market structure level.

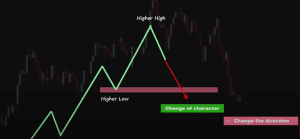

Looking at the diagram above, the most recent higher high and higher low is the one we monitor, when the price breaks the most recent high and low to the downward side, it means the price wants to start going downwards and wants to change its primary direction which has been the upside previously, this is what we consider a change of character.

The key point is this, for it to be considered a valid change of character (CHOCH), we need price to break and close a candle below the previous market structure level with a full body candlestick as shown in the diagram above.

If price breaks the most recent structure with a shadow, and closes in the most recent structures range, this means the change of character is invalid as shown in the diagram above. The same concept applies to the bearish scenerio.

Pro Tip: You should always remember that, in the SMC trading strategy, Change of character (Choch) is valid only on one condition, that price reversed and came from a supply or demand zone, before breaking the recent structure and creating the CHOCH.

If price, without mitigating a supply or demand zone creates a change of character even with a valid candlestick pattern, we cannot consider it a valid change of character(CHOCH).

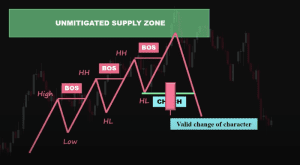

For example, in the diagram above, we have a bullish market, where price makes its higher highs and higher lows, we can also see in the diagram that price created a change of structure (CHOCH) after it mitigated the higher timeframe supply zone, after confirming that price mitigated a supply or demand zone, the next thing to look at is the candlestick, we would see if the candlestick closes below the last higher low in the diagram above with the body of a bearish candle and not the wick.

If the candlestick pattern is valid, then we can assume that price wants to change its direction and the change of character is safe to trade, as shown in the diagram above.

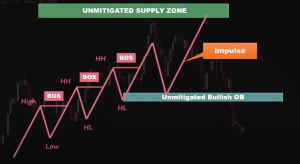

However, if price did not mitigate the upper-level supply zone, we would have a structure like shown in the diagram above. In this case, if price gets to a higher low level, it would be rejected when it gets to the unmitigated order block and start a fresh impulsive wave to the upside instead of changing direction.

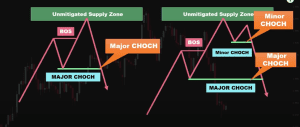

As I have mentioned earlier, the change of character in SMC trading strategy occurs in two ways which are minor and major character changes. Let’s take a look at what the minor and major CHOCH are.

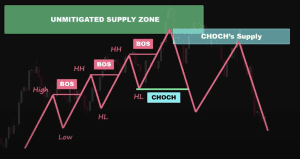

Looking at the structures above, on the left side of the diagram, we have the figure of the major CHOCH, and on the right corner, we have the figure of the minor CHOCH. The next thing that comes to our mind is, what is the difference between them?

The major change of structure occurs when price breaks a structure that has created a BOS. As you can see in the chart above, the price has broken down below the structure, which already creates a BOS, on the other side as you can see, price has broken the minor structure, but that cannot be called a BOS, as price needs to break the major structure just below the minor structure before we can confirm price is about to change directions.

Why I had to illustrate this, is because I have seen many SMC traders eagerly or nervously consider a minor change of character a valid change of character, and end up losing their trades.

Now that we have a basic knowledge of the change of structure technique in the SMC trading strategy, let’s move to some practical examples using real-time charts and applying the principles we have learned.

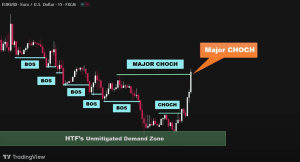

So in the above diagram, we are on a 15 mins timeframe for the Eur/Usd pair on the charts. As you can see price created a series of BOS to the downside until it got to the unmitigated demand zone which was created in a higher timeframe and then reverse to the upside.

In the next diagram above, we can see that price has broken out of the structure to the upside in the diagram above, so we spot a CHOCH, but before taking action, we have to ask ourselves a question, can we consider this Change of character a sign of a valid market shift? The answer is No because price has broken out of a structure that couldn’t create a BOS.

Therefore, we cannot be sure that a market shift is going to happen, as what we spotted in the diagram above is a minor CHOCH, so we need to wait for price to make a major change of character (CHOCH).

In other to have a major change of character (CHOCH), the market needs to close above the market structure which has created a bearish BOS as indicated by the green line in the diagram above with a full body bullish candlestick.

Now as we can see from the diagram above, we have a major CHOCH here that indicates the downtrend is over and the market structure shift is going to happen.

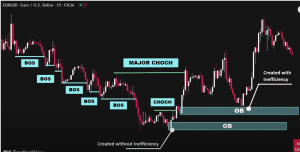

There is a crucial point I want to draw your attention to, as you can see in the above diagram, price has changed its direction to the opposite after creating a CHOCH, but did price respect the minor CHOCH demand zone which is indicated by the lower Order Block (OB) in the diagram above, or did it respect the major CHOCH demand zone indicated by the upper Order Block (OB).

It is obvious that price did not respect the minor change of character demand zone, and if you had a buy order in the minor CHOCH demand zone, you would have missed out on such a great opportunity, because price always has more tendency to respect the major change of characters instead of the minor CHOCH.

Let’s move on to the second example:

Looking at the chart above, we can also see that we are in a strong downtrend with price creating several BOS, we can see from the chart above that price has touched the higher timeframe demand zone, reacted to it, and went to the upside.

In the following price movement, we can see that price has broken the market structure with a little body candlestick at the green line and created a minor CHOCH, because the last lower high couldn’t make a BOS to the downside.

Most SMC traders consider this movement in the above chart diagram a market structure shift, they expect to price to change its direction to the upside so that they would place their buy order at the highest point of the area which is created by the CHOCH.

But as you can see in the diagram above, a market shift did not happen, as price did not respect the demand area, and STOP LOSS of traders who have entered the market for a buy would be hit by the price movement making them end up with some losses.

In summary, this change of character analysis increases your chances of getting more successful trades instead of just taking any trades without confirmation.

Now that we have seen how the change of character works, we will examine how we can use the change of character patterns to enter and exit trades with great risk-to-reward ratios.

Change of Character (CHOCH) Entry Setups:

There are two different types of entry you can make use of while using the CHOCH entry setup namely: Aggressive Entry and Conservative Entry.

I would only be using the Aggressive entry in my illustration as that is what I use in my trading, as I stated earlier in this article.

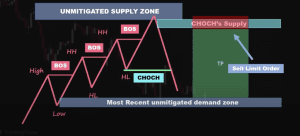

Let’s imagine price has created a bullish pattern to the upside, as shown in the diagram above, after reaching the higher timeframe supply zone, price is then rejected downwards and forms a major CHOCH by breaking and closing below the structure, i.e below the green line in the above chart, which has created a bullish BOS.

So using the Aggressive entry method in the SMC trading strategy, the next step would be to set a sell limit order at the lowest point of the supply zone, which is created by the CHOCH wave to the downside, as shown in the diagram above.

We should then place our STOP LOSS a couple of pips above the supply zone, then target the most recent unmitigated demand to place our TAKE PROFIT point. You can see the illustration in the above diagram.

This is the general idea of using the aggressive entry for CHOCH in the SMC trading strategy.

Read Also: 7 Candlestick Patterns Every Trader Should Know

Frequently Asked Questions (FAQ) on SMC Trading Strategy

Which time frame is best for SMC trading?

Who is the founder of the SMC trading strategy?

Does SMC Trading Work?

The effectiveness of smart money concept (SMC) trading is a subject of debate within the trading community, and opinions on its success vary.

Does SMC work in Crypto?

SMC means Smart Money Concept and it is a trading strategy that can be used across the financial market, as long as it involves the use of charts and technical analysis. Therefore, when trading crypto futures or spot markets, SMC strategy can be very helpful in determining key zones as well as entry and exit points.

What are the best indicators for the smart money concept?

Conclusion:

Something else to note is there are several ways in which SMC traders trade using the Smart Money Concept, and the pattern I used is just one of them, which relies mainly on the Change of character (CHOCH) and the market structure.

Another point to take note of is that this way of using the SMC trading strategy relies heavily on using the sell limit, buy stop, sell stop, and buy limit, as you cannot instantly execute a trade except you are sure of the valid CHOCH and also confirmed a BOS.

Finally, as there are several strategies lots of traders use for themselves, but it is important to understand that the SMC trading strategy is one of the few that stands out, as it is able to cover several aspects of the market, with its dynamic styles that encompass, lots of price action strategies, making its analysis, more accurate and clear.

I hope you have been able to learn something from this article, and that you now have a basic knowledge of what the smart money concept is in trading. Please do well to leave a comment and a like, and you can also help share this article to enlighten more traders.

If you have gotten to the end of this article, i am really glad because this means you find this usefull and of value.

I never thought i would say this but, here i am, pleading that you make your positive comments, leave a review and share this article and every other trading article on this platform that you think deserves to be seen.

Google has just taken down a lot of our valuable articles, just because they think we don’t have a voice and our domain authority seems low.

But I know that You, the people, our readers still have the power of choice and with your unanimous reviews, comments, shares and support, we will build a stronger community that will help more people acquire the knowledge and insights we share here without any cost.

Thanks for the review, comment and shares, and most importantly, thanks for taking out time to read this article.

Also Kindly subscribe to our Newsletter here on the Website….

You can get this article in pdf format, click the button below to download the SMC trading strategy pdf format.

«« Download PDF »»

We Hope you’ve learned a lot from this article!! We’re glad you did.

Join our telegram community to get up-to-date news, educational materials, free online classes, market analysis, and crypto futures trade signals that will help you grow and become profitable.

Subscribe to our newsletter, to get more educational content, tips, and updates.

Really appreciate with your article as your explanation make me so energetic and strong to push my self into trading

You have already changed some lives out here thenks

Thanks a lot for the feedback, I am glad you found the article useful.

You are the best!!

Thanks a lot for the feedback Mr. Eze, it really means a lot.

Bro! u can teach really well…… I feel like I’m gon rub the the market with the SMC strategy.

Thanks!!

Thanks a lot for the feedback, would be dropping more in-depth articles on SMC, you can also read other trading articles on the website, i think you will like them.

Clearly explained, I’m sure i have learned something crucial about SMC trading strategy. Thanks much!

I am glad you found some value, please subscribe for more detailed trading articles

You stated that the limit order would be in the supply zone, can you add how you define a supply zone?

Kindly search for and read my article on supply and demand zones trading strategy also on the website, to get a total understanding on how to do that. thanks for the feedback.

Very well explained, but one thing i was not able to understand is how to find order block(OB)?

Thanks, we are glad you gained some value. On how to find the Order Block, kindly navigate to the TRADING EDUCATION Category and read the article “Smart Money Concept Trading for Beginners” we were able to throw more light on the OB.