Moving Average Strategy Pdf Guide

In the fast-growing and ever-evolving financial market, mastering moving averages is a basic skill for traders looking to gain a competitive edge. This is especially for seasoned day and swing traders; it is also important for investors.

Understanding moving averages can significantly impact your trading decisions and overall profitability across various market conditions. This is why I have decided to put together a detailed Moving average strategy pdf guide to help traders understand the different types of moving averages, their calculations, practical applications in trading, common pitfalls to avoid, advanced strategies, and their broader implications beyond finance.

Moving Averages are arguably the most used indicator by traders on their price action charts, as they can easily track and identify trends by smoothing the market’s fluctuations. In layman’s terms, this makes it easy for a trader to identify the direction of the market while taking out the market noise or fluctuations.

The moving average can be described as a technical indicator that helps you smooth out price action giving you a clearer picture of the price movement. It can also identify the predominant trend in a market and provide dynamic support and resistance levels as the market moves higher or lower.

The moving average shows the average price of an instrument over a certain period. As the price changes, its moving average either increases or decreases.

The most basic and common application of moving averages is identifying the trend direction. It can also be used in calculating any sequential data sets, opening and closing prices, high and low prices, trading volume, and along with other indicators.

TYPES OF MOVING AVERAGES

There are several types of moving averages, and each has its use, strong points, and application, depending on how they compute their averages. Below are the different types of moving averages we have:

- Simple Moving Averages (SMA)

- Exponential Moving Averages (EMA)

- Linear Weighted Moving Averages (WMA)

- Smoothed Moving Average

In this article, we will examine the above-mentioned averages separately, explaining their uses, how they are calculated, and how they can be applied in trading. The first on our list is the (SMA), which is the most popular on the list.

WHAT IS SIMPLE MOVING AVERAGE (SMA)?

The SMA tool is used for technical analysis to determine the average price over time of an asset. The SMA provides an average line representing the value of that asset over that period.

SMAs are calculated by adding up the prices of the last few periods and dividing that sum by the total number of periods. The SMA advances each time there is a new data point, adding it to the previous one.

Calculating the simple moving-average formula is (Summary of Data Points in Moving Average Period)/(Total Number of Periods). Let’s use the following example to show how SMAs work and where the SMA lines are placed on the chart.

To understand how to calculate a SMA, let’s look at an example. Let’s say we had the following closing values for an asset:

Day 1 : $ 43.41

Day 2 : $43.52

day 3 : $43.21

day 4 : $43.77,

Day 5 : $43.58 and

Day 6 : $43.63.

To calculate the 6 Day SMA we would add up the closing prices of the previous 6 days, then divide by 6.

6-Day SMA = (261.12 / 6 ) = $43.52 This is the 6 Day SMA.

Therefore, the 6-day SMA for this asset is $43.52, representing the average closing price over the past 6 days.

WHY IS SIMPLE MOVING AVERAGE IMPORTANT?

SMA plays a crucial role in technical analysis as it helps identify trends, support, and resistance levels in price charts. Traders and analysts use SMAs to smooth out short-term price fluctuations, making it easier to detect underlying trends. By observing the relationship between the asset’s current price and its SMA, market participants can make informed decisions about buying or selling.

Moreover, SMAs of different timeframes can be compared to determine crossovers. When a shorter-term SMA crosses above a longer-term SMA, it may signal a bullish trend, indicating a potential buying opportunity. Conversely, when a shorter-term SMA crosses below a longer-term SMA, it may suggest a bearish trend, indicating a potential selling opportunity.

WHAT IS EXPONENTIAL MOVING AVERAGE (EMA)

The Exponential Moving Average, or EMA for short, is a popular technical indicator that gives more weight to recent prices. This is achieved by applying a percentage of today’s closing price to yesterday’s moving average. The main difference between the EMA and the Simple Moving Average (SMA) is that the EMA places a higher weight on recent market moves.

As a result, the EMA reacts more quickly to recent price changes than the SMA. To calculate an EMA, you need to start with an SMA as the previous period’s EMA, then calculate the weighting multiplier, and finally calculate the EMA for each day between the initial EMA value and today.

The formula for a 10-day EMA:

Initial SMA: 10-period sum/10

Multiplier: (2 / (Time Periods + 1)) = (2 / (10 + 1)) = 0.1818 (18.18%)

EMA: {Close — EMA (Previous Day)} x Multiplier + EMA (Previous Day)

LINEAR WEIGHTED MOVING AVERAGE

The weighted moving average is a type of moving average that assigns different weights to each data point in the moving average period when calculating the average. The exponential moving average is a weighted moving average that gives exponentially increasing weight to the elements in the moving average period.

On the other hand, the linearly weighted moving average assigns a linearly increasing weight to the elements in the moving average period.

For instance, if there are ten data entries in the period, the most recent element will be multiplied by ten, the ninth element by nine, and so on until the first element, which will have one multiplier. All these linearly weighted elements will be added and divided by the sum of the multipliers, which is 55 in the case of 10 elements.

The chart above displays the three types of moving averages (SMA, EMA, and LWMA) for 30 days. As shown on the chart, the weighted moving average responds more quickly to changes in the price curve than the simple moving average but is slightly slower than the EMA. This is because LWMA places slightly more emphasis on recent data than the EMA, and the weights for each new data point increase exponentially in the case of EMA.

SMOOTHED MOVING AVERAGE

The Smoothed Moving Average (SMA) is a type of Exponential Moving Average (EMA) that is characterized by having a longer period applied to it. This means that it takes into account all available data series and gives equal weight to recent prices as well as historical prices.

The calculation of SMA involves subtracting yesterday’s smoothed moving average from today’s price, then adding the result to yesterday’s smoothed moving average to arrive at today’s moving average. A moving average is an indicator that shows the average price of a contract over the previous n-period closes. It is used to observe changes in price movements.

By smoothing out the price movement, the longer-term trend becomes less volatile and more apparent. The SMA is used by traders and investors to identify trends in the market. When the price rises above the moving average, it indicates bullish investors, while a fall below indicates a bearish market. In addition, longer moving averages are used to isolate long-term trends.

Using the Smoothed Moving Average provides a clearer picture of market trends, making it easier for traders to make informed decisions. It is an effective short-term and long-term analysis tool, as it smooths out the noise in price movements and allows for a more accurate interpretation of market trends. Overall, the SMA is a valuable tool for traders and investors looking to gain insights into market trends and make informed decisions based on those trends.

At this point, we should understand the varying types of moving averages and how they function. It is also good to know that all the MA can be used simultaneously, depending on the trading strategy you are using as a trader. Now that we have established that, let us move on to the utility of these moving averages and how best they can be used.

WHAT MARKETS IS A MOVING AVERAGE USED IN?

Moving averages can be a useful tool in financial markets, particularly the Forex market, which is known for its high liquidity. Although stocks can also be a good option, their liquidity may decline when moving away from blue chips.

The benefit of using moving averages is that they smooth out data, enabling you to focus on trends rather than daily price fluctuations. The effectiveness of the moving average is dependent on the time frame used. Depending on your time horizon, you can apply this length to any chart time frame.

Furthermore, the “look back period” you choose can impact the moving average’s effectiveness. In some stock or financial markets, EMAs may be more effective than SMAs because they give more weight to recent prices, while SMAs may work better in other situations.

Download Moving Average Strategy PDF

WHAT ARE THE MOST COMMON MOVING AVERAGES?

200-DAY SIMPLE MOVING AVERAGE

The 200-day M.A. is an incredibly valuable technical analysis tool traders use to assess the overall long-term trend of a security. It is a simple yet effective way of analyzing price trends by reviewing a security’s average closing price over the last 200 days.

To calculate the 200-day moving average, one must gather the instrument’s closing prices for each day over the last 200 days. Then, the closing prices would be added, and the sum would be divided by 200. This calculation would accurately represent the instrument’s average closing price over the last 200 days.

The 200-Day Moving Average is particularly useful for investors who want to assess whether an instrument is on an upward or downward trend over an extended period. By analyzing the 200-day moving average, investors can decide whether to buy, sell, or hold an instrument.

Overall, the 200-Day Moving Average is a critical tool for anyone interested in trading or investing. Its simplicity and accuracy make it a go-to resource for technical analysis, and its insights can help investors make informed decisions about their portfolios.

You can get the 200 moving average by taking the instrument’s closing price over the last 200 days.

[(Day 1 + Day 2 + Day 3 + Day 4 + Day 5 + …. + Day 198 + Day 199 + Day 200) / 200]

= 200-day moving average

50 DAY MOVING AVERAGE

The 50-day moving average is a widely used technical indicator among investors that aids in predicting and monitoring price trends. Essentially, it is computed by taking the average of a security’s closing price over the previous 50 days, which is calculated by adding up the closing prices of each of the 50 days and dividing the sum by 50.

This provides the value for the 50-day moving average, which is a helpful tool for investors to analyze market trends and make informed financial decisions.

It is calculated by averaging an asset closing price over the last 50 days using the following formula: [(Day 1 + Day 2 + Day 3 + Day 4 + Day 5 + … + Day 48 + Day 49 + Day 50) / 50] which equals the 50-day moving average.

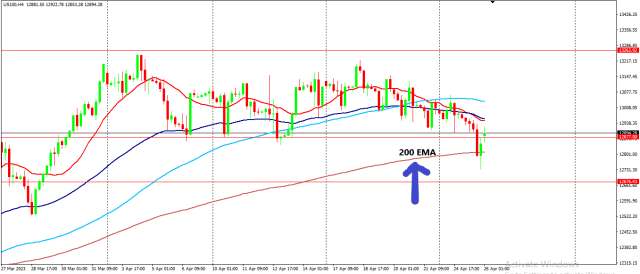

200 – DAY EMA

When engaging in forex trading, utilizing a tool such as 200 EMA can be quite advantageous to help you determine the trend before entering into any trade.

It is vital to understand that 200 EMA is utilized to differentiate between bull and bear territory. To use it effectively, it is important to know that prices below 200 EMA signify a downtrend, while prices above it indicates an uptrend.

To make the most out of this tool, it is recommended that you use price action charts to determine where to place a stop order and to take profit based on previous swings. You should place 200 EMA on your daily chart to get started and determine the trend.

Once you have done so, switching to the 4-hour chart is advisable to see if the trend remains consistent. Finally, you should check the 1-hour chart to confirm the trend before executing your trade entries. By adhering to these steps, you can make more informed trading decisions and improve your chances of success in the forex market.

.

.

.

USES OF THE MOVING AVERAGE STRATEGY IN YOUR TRADING?

The main function of the Moving Average is to identify trends and reversals, find support and resistance, and measure an asset’s momentum. Moving Averages help to define the trend and recognize changes in the trend. Many traders, however, make fatal mistakes when using moving averages.

TREND ANALYSIS

When it comes to trend analysis, it’s important to note that Moving Averages aren’t particularly helpful for predicting new trends due to their lagging nature.

However, they can be valuable for tracking and confirming trends that have already been established. Additionally, the moving average crossover can be a useful tool for identifying potential new trends.

SUPPORT & RESISTANCE

Another way that MA’s can be helpful is by determining dynamic support and resistance levels. If you notice that an asset’s price is falling, it’s common for it to eventually stop and reverse direction around the same level as the average.

Stocks often reverse either up or down around price levels that are close to popular M.A’s, since these levels serve as confirmation levels.

Read Also: The Best Trading Indicators for Beginner Traders in 2023

INCORPORATING MOVING AVERAGE STRATEGY INTO YOUR TRADING STRATEGIES

Moving averages are a highly valued tool for many traders in determining their trading strategies. Traders rely on the intersection of moving averages and their relationship with the price to make informed decisions on when to buy or sell.

An extensively used technique is to track the 50-day and 200-day moving averages. When the short-term average crosses above the long-term average, it signals a potential bullish trend. Conversely, when the short-term average falls below the long-term average, it indicates a bearish trend.

Moreover, traders may use price interactions with moving averages to confirm their trading decisions. For example, if the price retraces to the moving average and finds support, it can be viewed as a favourable opportunity to buy. Conversely, if the price encounters resistance near the moving average, it could be a signal to sell.

These are just a few ways traders utilize moving averages in their trading strategies to increase their chances of success.

Let’s examine the moving average crossover strategy and how to use the moving average as a dynamic support and resistance level in detail, as both of these methods can also be used as a trading strategy. However, a need for confirmation and signal confluence cannot be neglected.

MOVING AVERAGE CROSSOVER STRATEGY

Traders often rely on crossovers to make objective decisions and eliminate emotions when trading. These signals are fundamental and help determine entry and exit strategies, as well as identify momentum shifts.

The most popular crossover used by traders is the moving average crossover. It’s particularly useful for analyzing trends, but it’s important to note that it can’t predict future direction with certainty.

Traders usually employ two or more moving averages, including a faster moving average and a slower moving average. The former is more reactive to daily price changes and reflects recent market trends more accurately due to its shorter period.

All in all, crossovers are a valuable tool that assists traders in making informed decisions when buying and selling assets.

Moving Averages Support & Resistance Strategy

Using moving averages as support and resistance levels is another effective strategy in trading.

The moving average support and resistance levels differ from traditional horizontal support and resistance lines. This is because they adjust continuously based on recent price movements, making them always up-to-date.

Many forex traders view these moving averages as significant support or resistance points. They tend to buy when the price dips and tests the moving average or sell when the price rises and touches the moving average.

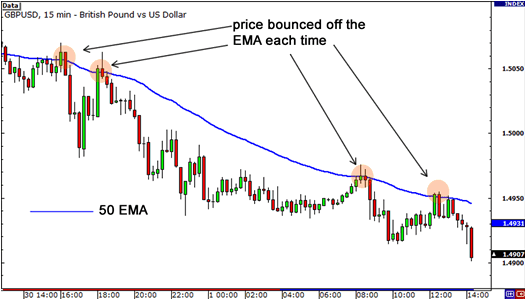

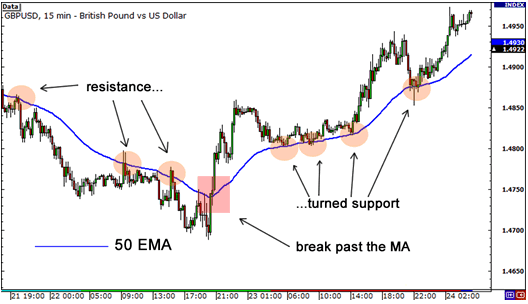

Let’s examine a practical example on the 15-minute chart of GBP/USD by adding the 50 EMA to observe its behaviour as dynamic support or resistance.

Observing the chart, we can see that the 50 EMA effectively acted as resistance each time the price approached and tested it. This demonstrates its ability to influence price movements.

However, it’s important to note that like traditional support and resistance lines, price may not always bounce perfectly from the moving average. Sometimes, it may briefly surpass it before reverting back in the direction of the trend.

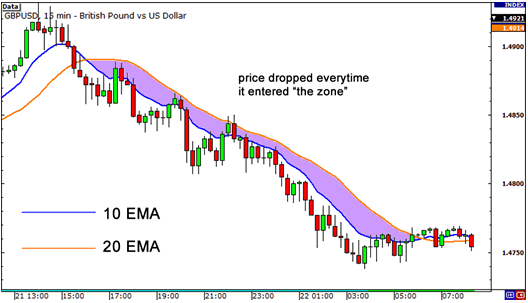

To enhance this strategy, some traders utilize two moving averages and only execute trades when the price is between them, creating what we call “the zone.”

Let’s further analyze the 15-minute chart of GBP/USD, this time using the 10 and 20 EMAs.

Examining the chart, we notice that the price slightly exceeded the 10 EMA before retracing. This approach is favored by intraday traders who treat moving averages as zones or areas of interest, similar to horizontal support and resistance areas.

However, it’s crucial to recognize that just like traditional support and resistance levels, moving averages can also break. Let’s revisit the 15-minute chart of GBP/USD focusing on the 50 EMA.

As depicted in the chart, the 50 EMA initially served as a strong resistance level, causing the price to bounce off multiple times. However, eventually, the price broke through the 50 EMA, indicating a shift in momentum. Subsequently, the 50 EMA acted as a robust support level as the price retraced and tested it again.

Common Mistakes to Avoid When Using Moving Average Strategy

Let’s delve deeper into the common mistakes traders make when utilizing the moving average strategy:

Misinterpreting Signals:

One common mistake is relying solely on moving averages for trading signals without considering other indicators or the broader market context. Moving averages provide valuable insights into price trends, but they should be used in conjunction with other technical indicators or fundamental analyses to validate signals.

Ignoring complementary indicators or failing to analyze market sentiment can lead to misinterpretation of moving average signals and erroneous trading decisions.

Over-reliance:

Another common pitfall is over-reliance on moving average signals without conducting a comprehensive analysis or considering fundamental factors. Traders may blindly follow buy or sell signals generated by moving averages without evaluating the underlying market conditions, such as economic data, geopolitical events, or sector-specific trends.

Over-reliance on moving averages alone can lead to suboptimal outcomes and missed opportunities, as they may not always accurately reflect market dynamics or provide timely signals in rapidly changing conditions.

Ignoring Market Context:

Failing to analyze broader market trends and economic factors is another critical mistake. Moving averages are influenced by various external factors, including market sentiment, investor behaviour, and macroeconomic trends. Ignoring the broader market context and economic fundamentals can result in misinterpreting moving average signals.

For example, a moving average crossover may signal a trend reversal, but without considering the overall market sentiment or economic indicators, traders may overlook the underlying market dynamics and make erroneous trading decisions.

In summary, avoiding these common mistakes requires traders to supplement moving average analysis with other technical indicators, conduct thorough analysis before making trading decisions, and consider broader market trends and economic factors to interpret moving average signals accurately.

Read Also: 8 Chart Patterns Every Beginner Trader Must Know to Succeed in Trading

CONCLUSION

It is essential to note that every trader and investor who employs technical analysis to analyze the market should be able to identify possible support and resistance levels and easily identify the market trend they are trading.

Moving averages play an important role in this situation.

Traders and investors can use moving averages to smoothen out price data, highlight trends and identify the overall direction. This can be seen in the strategies we highlighted in this moving average strategy pdf guide. Also, traders and investors gain insight by using moving averages that are simple, smooth, or exponential.

You should be aware that staying up to date with the market using moving averages can give you a significant competitive edge in the complex and dynamic world of trading/finance. It is, therefore, highly recommended that traders and investors use moving averages in their investment and trading strategies.

Download Moving Average Strategy PDF

SEE OTHER DOWNLOADABLE PDF ARTICLES

The Best Day Trading Strategy PDF Guide in 2024

24 Powerful Candlestick Patterns PDF Guide

Taking Profitable Trades Using Trading Chart Patterns PDF Guide

Smart Money Concept Trading PDF

The Best Price Action Trading PDF Guide For Beginners

Are you interested in joining a community where you can learn all you want to know about the cryptocurrency space, defi, web3, and forex trading and also have access to live AMA sessions from time to time, then click the button below to join Dipprofit Telegram Community For Free Now.