What is Drawdown in Forex Trading?

Drawdown in forex trading refers to the reduction in the value of a forex trader’s investment or the reduction in the amount of equity in a trading account over a period of time. It is a measure of the peak-to-trough decline of an investment or trading account.

In simpler terms Drawdown in forex trading refers to the total amount of money, capital, or equity a forex trader is either willing to lose or has already lost in his trading account.

For example, if an investor starts with a trading account balance of $100,000 and then suffers a series of losses that reduces the account balance to $90,000, the drawdown in the Forex trading account of the investor would be $10,000. In other words, the drawdown is the difference between the highest point of the account balance and the lowest point of the account balance over a given period of time.

Another example is if a Forex trader opens his trading account with an equity of $100,000 and sets his maximum loss to a limit of $10,000 monthly, we can also say that the drawdown for this trader is either 10% or $10,000.

There are various types of Drawdowns in forex trading and every forex trader can use the one they are comfortable with, or the drawdown that complements their strategy, this would in turn produce a much more effective trading result. As we look into the types of drawdowns available in forex trading, you can find for yourself the one most suitable.

Types of Drawdown in Forex Trading

Equity Drawdown:

Equity drawdown in Forex trading is the difference between the trading account balance at its peak and the current account balance, this can be expressed as a percentage of the peak account balance. For example, if the highest equity a trader has ever had in their account is $50,000 and their current account balance or equity is $35,000, the Equity drawdown in this account is $15,000 and it would be represented in percentage as 30%.

Balance Drawdown:

Balance drawdown in forex trading refers to the difference between the initial account balance and the current account balance, expressed as a percentage of the initial account balance. For example, if a forex trader opens his forex trading account with an initial equity of $15,000 and currently has $12,500 left in the trading account, the balance drawdown here is $2,500 and can be expressed in percentage as 16.67%.

Margin Drawdown:

This refers to the reduction in the available margin that occurs when a losing position reduces the account balance to a level where there is insufficient margin to maintain the position.

Peak-to-Valley Drawdown:

This type of drawdown in forex trading refers to the difference between the highest account balance of a trading account and the lowest account balance during a given period of time. Let’s assume, a day trader accesses his trading account on a monthly basis and one of the assessments he carries out is to determine the drawdown on his account for the month.

The peak to valley drawdown for the trading account would be the highest account balance for that month, which may be the balance at the beginning of the month and the lowest trading account balance of the same month. This helps the trader ascertain the progress he or she is making over the months period.

System Drawdown:

This refers to the decrease in performance of a trading system, strategy or method during a certain period of time. It’s calculated as a percentage of the system’s peak performance.

Importance of Drawdown in Forex Trading

Drawdown in forex trading is an important concept in forex trading because it can indicate the level of risk associated with a particular trading strategy or system. A higher drawdown means that the trader is taking on more risk, as the potential for losses is greater. On the other hand, a lower drawdown means that the trader is taking on less risk, as the potential for losses is smaller.

Drawdown in forex trading also helps forex trader effectively manage their trade portfolio, as it helps them implement proper risk management strategies by setting drawdown limits which would in turn save them from depleting their equity.

It is also very important for traders to understand and manage drawdowns, as they can have a significant impact on the overall performance of a trading strategy or system. This can be done through the use of risk management techniques such as position sizing, stop-loss orders, and diversification.

Ways to implement drawdown in Forex Trading

Set a maximum drawdown limit: Traders can set a maximum drawdown limit for themselves, beyond which they will stop trading or take some other action to mitigate the risk. This can help the trader avoid excessive losses and protect their account balance.

Use risk management techniques:

A trader can use risk management techniques such as setting stop-loss orders, taking profits at regular intervals, and diversifying their portfolio to reduce the impact of drawdown.

Monitor drawdown closely:

It is important for a trader to closely monitor their drawdown and take action if it exceeds their maximum drawdown limit. This can help the trader identify any issues with their trading strategy and make necessary adjustments.

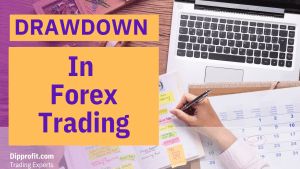

Use a drawdown calculator:

A trader can use a drawdown calculator to track their drawdown and understand its impact on their account balance. There are many free online tools available that can help a trader calculate their drawdown, one of the tools that can be used to calculate drawdown in forex trading is myfxbook. Also, Propriety trading accounts have tools that can help in calculating trading account drawdown.

By implementing drawdown in their trading, a trader can better manage their risk and increase the chances of long-term success in the forex market.

Advantages of using drawdown in forex trading as a risk management strategy:

Measurement of risk:

Drawdown provides a way to measure the risk of a forex trade or portfolio by quantifying the amount of loss that has occurred over a certain period of time. This can be useful for investors and traders who want to understand the level of risk associated with their trades and make informed decisions about whether to continue holding onto them.

Setting stop-loss orders:

Drawdown can be used to set stop-loss orders, which are designed to help limit the size of the drawdown by automatically closing out a trade if it falls below a certain level. This can help investors and traders to minimize their potential losses and protect their capital.

Preservation of capital:

By using drawdown to set stop-loss orders and manage risk, investors and traders can help to preserve their capital and prevent large losses. This can be especially important for traders who are using leverage, as large losses can quickly wipe out an entire trading account.

Improved risk management:

Overall, using drawdown in forex trading as a risk management strategy can help investors and traders to make more informed decisions about their trades and to manage risk more effectively. This can lead to better risk-adjusted returns and a more successful trading experience.

How to Manage Drawdown in Forex Trading

Through Risk Management:

For every forex trader, drawdowns are inevitable, hence the need to manage them properly, and applying risk management strategies is one of the best ways to reduce drawdowns in forex trading. Having a maximum drawdown limit is very important as it helps the forex trader control the losses on their trading account.

The trader sets a percentage limit on the maximum amount of loss the trading account can take over a period of time. It is very commonly used by Propriety traders when trading with Propriety accounts.

For example, if a trader decides to fund his trading account with $100,000, the trader then goes ahead to set a drawdown on the account at 15%. What this means is that the maximum loss the trader is allowed to incur on the account is 15% of the total equity which in this case stands at $15,000.

This would further allow the trader to become conscious of the risk they take on every trade, as they already have a drawdown limit. It would allow the trader to manage the lot size used on each trade, and also the level of risk allowed on the trade

Position sizing and leverage control:

Position sizing is also a very effective way to manage drawdown in forex trading and it is used by forex traders to determine the appropriate amount of a particular asset to buy or sell based on the size of their trading account and the level of risk one is willing to take. It is typically expressed as a percentage of the trader’s account balance. For example, a trader who has his drawdown set at 20% and decides to take five (5) trades might decide to only risk 2% of their account on each of the trades, bringing it to a total of 10% for the five (5) trades.

Leverage control, on the other hand, involves limiting the amount of borrowed funds a trader or investor uses to enter a position. Leverage allows traders to control a larger position with a smaller amount of capital, but it also increases the risk of losses. When a trader has a drawdown percentage set on their original Equity, they are able to also limit the leverage they allow on their trading account. By controlling the amount of leverage used, traders can limit their potential losses.

Having a trading plan:

Another way to manage your drawdown in forex trading is to have a trading plan, this would help the trader come up with trading strategies that would reduce the drawdown on their forex trading account. Every professional trader has a trading plan and strategies that they use to ensure that they are able to minimize losses while at the same time maximizing their profits.

These trading plans would be able to help the trader in understanding the currencies that are highly volatile and the strategies to use in trading those currencies if they decide to trade them.

It would also help the trader determine the amount the time to trade, currency to trade, lot sizes to use in trading, and strategies to apply.

Conclusion

It is very important for every aspiring forex trader to know their trading account drawdown. This is because having a drawdown in forex trading accounts is almost inevitable, therefore, having knowledge of a trade account drawdown would help the trader understand at a glance their trading performance, and also assist them in preparing a better trading strategy giving them a dynamic approach to their trading journey.

See Also: Common Terms in Forex: Spread, Pip, Lot size, and Leverage

Dipprofit Community

At Dipprofit we are currently growing a brilliant community of forward-thinking individuals who want to equip themselves with the necessary information and knowledge in this fast-growing digital age, helping them gain financial freedom and utilize the opportunities that come with it.

You can click on any of the buttons to join our communities on Facebook, Twitter Whatsapp, and Discord, as we share ideas and opportunities that would transform your life forever.